Improvements sought in VII CPC recommendations on retirement benefits

Dear Sir,

All India DRDO Technical Officers’ Association (AIDTOA) and Confederation of Central Government Gazetted Officers’ Organisations (CCGGOO) have submitted detailed memorandum to the 7th CPC on various demands, problems and grievances of the Central Government Pensioners. However, it must be sadly admitted that most of the issues, which we had projected before the Commission did not have a proper consideration, may be perhaps, due to the Commission’s perceived anxiety over the financial constraints of the Government of India. We have every reason to believe that their anxiety was not well placed, for the Government’s finances are far better presently than what it was two decades back.

The memorandum submitted by us had elaborately dealt with the issue concerning the relative capacity of the Government to pay its employees and pensioners in the background of accelerated growth of the economy, reduced tax burden on both business houses and the common people the reduced percentage of expenditure on wages, salary and pension with reference to the Government’s revenue resources, revenue expenditure and the GDP itself. The denial of the need based minimum wage, (in accordance with Dy. Aykhroyd formula) in other words, the bare existence wage in the circumstance by the 7thCPC is incomprehensible. We are pointing out this aspect of the recommendations, for the successive earlier Commissions had denied the need based minimum wage on the specious plea of the inability of the Government to pay.

We hope you will appreciate that the present pensioners, who were in active service in 1960s, 1970s, 1980s, 1990s, did suffer immensely as they were denied even the bare existence wages. They suffered on many counts, as they could not provide a decent standard of living to their families, could not construct a residential dwelling, and could not educate their children properly for sheer want of requisite finances, so on and so forth. The Pensioners’ community is presently concerned again with the minimum wage as the re-fixation of pension on account of the wage revision effected by the 7th CPC is linked to the minimum wage. We, therefore, appeal that the grievances presented by AIDTOA, CCGGOO and the Staff Side, National Council JCM on the determination of the quantum of minimum wage by the 7th CPC must be considered seriously and necessary corrections made.

Another important issue we would like to present before you, concerns the New Pension Scheme introduced by the Government of India, with effect from 01.01.2004. Both the Serving employees and Pensioners organisations placed before the Commission, rather passionately, to consider their submissions made for the replacement of the newly introduced defined contributory system of pension for those who entered the Government of India Service from.1.1.2004 with the time tested defined benefit scheme of pension. As of date the Government employees, by virtue of the new contributory pension scheme are divided into two classes viz. a good number of them receive emoluments after deduction of 10% towards pension contribution whereas the other for the same job is provided with a higher rate of emoluments. It is nothing but a blatant denial of equal pay for equal work.

We had pointed out to the Commission in no uncertain terms that the new scheme was conceived as an idea to allow the flow of the hard earned income of the employees to the Stock market and permit the access of those funds for the corporate houses with no guaranteed return to the contributor. We had pleaded before the Commission to recommend for the exclusion of the Government employees from the purview of the NPS, if the scrapping of the scheme is infeasible in the light of the enactment of PFRDA.

The Commission, as you could see from the report, has enumerated innumerable flaws, defects, deficiencies and what not in the administrative apparatus of the NPS, which has now amassed huge funds and its coffers are swelling enormously day by day. They have still not evolved a mechanism to monitor the remittances by the concerned employers.

The Commission has suggested in the light of their findings, cosmetic remedial measures which in all fairness one should admit, will not address the issue.

In short, the Commission has not been emboldened to make a positive recommendation for the exclusion of the Central Government employees from its ambit, even though they have been convinced of the force of our submissions and arguments. We may also state that the Commission which was anxious of the increased financial outflow on account of the revision of wages and pension did not, rather failed to recognise the enormous outflow of tax payers money to the pension fund in the form of Governmental Contributions. Without stating the various other demerits of the New Contributory Pension Scheme, as it has been oft-repeated, we plead that the Government employees be excluded from the Contributory Pension scheme and all of them irrespective of their date of recruitment be brought within the purview of the time tested defined benefit pension system.

Besides the submissions made in the preceding paragraphs, we enumerate here under some specific issues concerning pensioners and request the Implementation Committee to consider the same and place it before the empowering committee for acceptance.

1. Parity between the past and present pensioners be brought about on the basis of the 7th CPC recommendations with the modification that the basis of computation be the pay level of the post/grade/scale of pay from which the employee retired, whichever is beneficial to him.

The 7th CPC has recommended the modus operandi for bringing about parity between the past and present pensioners. While issuing orders in acceptance of this recommendation, we urge upon that care may be taken to provide the benefit to the pensioners as envisaged by the Commission in its letter and spirit. Often we find when the orders are issued, the same is interpreted by the pension disbursing authority in such a manner that the envisaged benefit is denied to the deserving personnel on flimsy technical grounds.

We want you to appreciate that it is not a perceived grievance but a real and genuine one. To cite a recent example, When the orders on the question of modified parity was issued after the 6th CPC recommendations, the benefit was denied to a large number of pensioners by such an interpretation made by the Offices of the Controller General of Accounts. The issue had to be agitated in the Central Administrative Tribunal, where the CGA’s interpretation was set aside.

The Government dragged the poor pensioners upto the highest court of justice in the country, the Supreme Court, before the concerned order was amended. Even in the amended order, care was not taken to convey the benefit to certain pensioners fully on the specious plea that the words employed in the original orders speaks only of the scale of pay and not of the revised scale of pay.

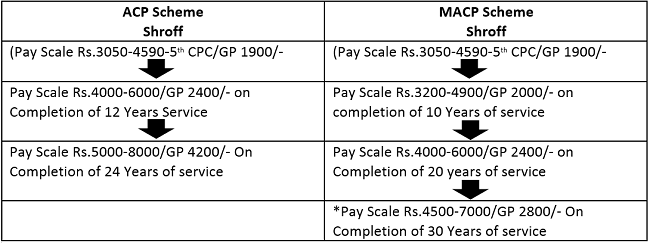

It is highly unethical to drag the pensioners to the Courts. They are compelled to bear the huge expenditure involved in the litigation at the level of the Supreme Court. To avoid the recurrence of such a scenario, we plead that the orders must specify in unambiguous terms, that the parity must be with reference to the level of pay of an individual employee of the post/grade/scale of pay from which he/she retired, whichever is beneficial to that individual. This is to take care of the situation where the concerned Government servant had been granted MACP, or the pay scale/pay band/grade pay/ had been revised by the Government either suo motu or on the basis of the recommendation of the Pay Commission.

2. Pension to be 60% of the last pay drawn and family pension to be 50% of the last pay drawn. Minimum pension to be 60% of the minimum wage and minimum family pension to be 50% of the Minimum wage.

In our memorandum, we had demanded that pension to be 66.6% of the last pay drawn and the minimum pension to be 66.66% of the minimum wage. The CPC has not conceded this demand. Our present request in the matter is that the pension must be fixed at 60% of the last pay drawn and the minimum pension at the rate of 60% of the minimum wage. This is on the ground that minimum wage is computed taking into account the family consisting of three units of two adults and two children ( i.e. 1+0.8+0.6+0.6=3) Since the requirement of the children can be excluded in the case of pensioners, the rational approach will be to provide 60% of the minimum wage as the minimum pension. Both the pension and the minimum pension has to be at the rate of 60% of the last pay drawn (or average emoluments) and the minimum wage respectively. The present stipulation of computing the pension at the rate of 50% and the minimum pension at 50% of the minimum wage has no basis at all. Family pension is granted mostly in the case of the surviving spouse or unmarried or widowed daughter. To reduce the pension beyond 10% is to heap misery and agony on the survivors. Our suggestion in the matter is that the surviving member of the family be provided with at least 50% of the pension.

3. Enhance the pension and family pension on the basis of the increased age of the pensioner. Grant 5% rise in pension for every addition of 5 years of age, 10% after attaining the age of 80 and 20% for those beyond 90.

The decaying process of physique gets accelerated normally after 60 years of age. To keep one fit, after the age of 60, increased expenses on various counts are needed. It was in recognition of this fact that the earlier Pay Commission suggested to calibrate the pension entitlement linking to the age of the pensioner. The demand was formulated to rein in a logical methodology for such increases. Our specific suggestion is to raise the quantum by 5% (i.e. 65% at the age of 65) and by 5% for every five year increase in the age of pensioner. However, the increase will have to be 10% at the age of 85 and 20% at the age of 90.

4. Restoration of Commuted value after 10 years and gratuity as per the provisions of the Gratuity Act.

It is now an admitted fact that the Government recovers the full value of the commuted portion of the pension in 10 years including the interest. However, it has refused to accede to the demand for a revision of the period of restoration when it was taken up in the National Council. There had been no reason adduced as to why this demand cannot be accepted, when the issue was subjected to discussions before the 7th CPC. Fifteen years is too long a period and the last five years in which the pensioner is denied the full pension is without justification. We request you to kindly place this fact before the Empowering Committee for a favourable decision. In the matter of gratuity our demand is that the Government must adhere to the provisions of the Gratuity Act and no distinction between the Government employees and the workers in the Public or private enterprises be made in the matter.

5. Fixed Medical Allowance.

In the case of pensioners who reside at locations not covered by the CGHS scheme has no health care benefit at all. The serving employees are entitled for CGHS benefit if they stay in any of the 26 cities where the CGHS facilities are available, and they enjoy the benefit of CCS (MA) Rules in other places. The Pensioners staying outside the CGHS areas are to bear the health care expenses from their meagre pension amount. It is in consideration of this fact; a fixed medical allowance was introduced. However, the quantum of such allowance is a paltry sum of Rs. 500/- p.m. In the neo-liberalised economic system, the administered price mechanism barring in the case of a few medicines, has been dispensed with, consequent upon which is the exorbitant prices of medicines in the market. The pensioner is not able to afford the prices of medicines. Either the Government must come forward to bring in the application of CCS (MA) Rules to the pensioners who are not within the ambit of CGHS or the FMA will have to be increased. We request that the FMA may atleast be raised to Rs. 2000 per month.

6. Grant of HRA for pensioners.

Gone are the days when the pensioner can expect to be looked after by their children. In most of the cases, they are unable to live with their children even if the children are willing to accommodate them. This is because of the frequent transfer of workplace and many other relevant factors. As has been pointed out elsewhere in this letter, the pensioners of date were the serving employees of 1970s, 80s and 90s. They did not have a decent wage structure nor could they obtain loan facility from the banks on nominal interest, with the result they could not venture to own a house for occupation atleast after retirement. Throughout their service career they had been in the occupation of the Government accommodation, which they had to vacate after retirement. The real estate business in the country witnessed a boom in 1990s and 2000s. The pensioners cannot compete in the real estate market either with the consumers or business people. All these factors put together makes the pensioners to shell out a major portion of their pension income only for hiring a dwelling place. We, therefore, request the Committee may consider the demand for HRA from a humanitarian point of view.

7. Grant of an increment prior to the date of retirement.

Grant of one increment in the case of those pensioners who retired on completion of one year in service as on the date of superannuation had been the demand of AIDTOA, CCGGOO and the staff side placed before the Government for their consideration in the National Council. The demand was rejected on the technical ground that even though they had worked for a full year, the grant of increment would be possible only if they are in service on the day when it become due. The 6th CPC while recommending uniform date of increment for all Government Servants also suggested that in the case of all employees who had completed more than six months, increment might be granted. The issue was taken up before the 7th CPC too through our memorandum. The Commission also did not recommend the acceptance of our demand. We therefore, appeal once again to the Government that this simple issue may be settled as it has very little coverage and the consequent financial implication is very meagre.

These are some of the issues, which pensioners have brought before us to take it up with you. We therefore, once again request you to kindly consider these issues in the light of the justification we have appended under each of them and recommend to the Government for a positive consideration thereof.

Thanking you,

Yours sincerely

General Secretary

All India DRDO Technical Officers’ Association (AIDTOA)

To

The Joint Secretary,

Implementation Cell,

Department of Expenditure,

Ministry of Finance,

North Block

New Delhi. 110 001.

Source ;- www.aidrdoto.blogspot.in